Determining Trend Strength: Average Directional Index ..

Contents:

I set out with the goal to create the trading program that… I am so happy to announce that our new trading program, the Tradecademy is finally online. Once the ADX hooked and turned down, price also started to reverse – the “ADX hook” is a good exit signal. ADX is simply the mean, or average, of the values of the DX over the specified Period. If the +DI is already above the -DI, when the ADX moves above 25 that could trigger a long trade. Welles Wilder in 1978, shows the strength of a trend, either up or down.

A reading between those two values, would be considered indeterminable. However, as previously mentioned, an experienced trader would not take the 25 and 20 values and apply them in every situation. What is truly a strong trend or a weak trend depends on the financial instrument being examined. Historical analysis can assist in determining appropriate values. Negative directional movement is defined in a similar way.

What is Volume in the stock market? How to use volume while trading?

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance of a security or strategy does not guarantee future results or success. Sets the number of decimal places to be left on the indicator’s value before rounding up.

ADX: what it is and how to use it - Capital.com

ADX: what it is and how to use it.

Posted: Thu, 15 Mar 2018 07:00:00 GMT [source]

The ADX, negative directional indicator (-DI), and positive directional indicator (+DI) are momentum indicators. The ADX helps investors determine trend strength, while -DI and +DI help determine trend direction. The two indicators are similar in that they both have lines representing positive and negative movement, which helps to identify trend direction. The Aroon reading/level also helps determine trend strength, as the ADX does. The calculations are different though, so crossovers on each of the indicators will occur at different times.

DI Contractions and Expansions

When the ADX is below 20, traders could use trading strategies that exploit range bound or choppier conditions. Most of our articles are centered across ‘Trend Following’ and its variations. We strongly believe that Trend is the best friend of every trader and would continue to be the same down the line. This article would focus on the most versatile Trend strength indicator used by Technical analysts know as Average Directional Index . We would learn how to trade with the help of these 3 indicators and always stay with the trend in correct direction.

Directional Movement Index (DMI) Definition - Investopedia

Directional Movement Index (DMI) Definition.

Posted: Sat, 25 Mar 2017 20:29:17 GMT [source]

Unless otherwise indicated, all data is delayed by 15 minutes. The information provided by StockCharts.com, Inc. is not investment advice. Trading and investing in financial markets involves risk. The chart above shows AT&T with three signals over a 12-month period.

The Negative Directional indicator (-DI) equals 100 times the EMA of –DM divided by the ATR. USA500 chart below we marked the first time the ADX breaks above the 20.00 level and then when the ADX broke back below the 20.00 level and signaled that the price has lost momentum. Look for currency pairs that are showing clear trends, either up or down. The ADX will be higher when a trend is stronger, so you should be able to easily identify strong trends by looking at the ADX value. The information contained in this article is not intended to be investment advice and is for educational purposes only.

How Does ADX Work?

When any indicator is used, it should add something that price alone cannot easily tell us. For example, the best trends rise out of periods of price range consolidation. Breakouts from a range occur when there is a disagreement between the buyers and sellers on price, which tips the balance of supply and demand.

The indicator lags and will therefore tend to indicate trend changes after the price has already reversed course. This could lead to some trade signals occurring too late to be of use. A reading of 20, or 25, or 30 doesn’t mean that trend will persist. Many trends will fizzle out after reaching such a reading. The indicator can’t predict a trend will continue, only that the security trended recently.

When the ADX turns down from high values, then the trend may be ending. You may want to do additional research to determine if closing open positions is appropriate for you. Wilder suggests that a strong trend is present when ADX is above 25 and no trend is present when below 20. The random walk index compares a security’s price movements to a random sampling to determine if it’s engaged in a statistically significant trend. According to Wilder, a trend is present when the ADX is above 25.

To calculate the ADX, you should first specify the positive (+) and negative (-) DM or directional movement. The +DM and –DM can be determined by calculating the “up-move” and the “down-move” . Primarily used for defining a trend strength, or momentum, the indicator is calculated according to the Average Directional Index formula. It beats trying to scale every peak and valley on a chart. Directional Movement is actually a collection of three separate indicators combined into one.

Therefore, chartists need to look elsewhere for confirmation help. Volume-based indicators, basic trend analysis and chart patterns can help distinguish strong crossover signals from weak crossover signals. For example, chartists can focus on +DI buy signals when the bigger trend is up and -DI sell signals when the bigger trend is down.

In other words, the ADX can potentially be used as a trend strength indicator. A simple and effective strategy that is used by many traders is a crossover strategy that uses the ADX in combination with the +DMI and –DMI lines. In this trading strategy an order is placed whenever the +DMI and –DMI lines cross, as long as the ADX is also above 25, indicating a strong trend. When the +DMI line crosses higher it is a buy signal and when the –DMI crosses higher it is a sell signal.

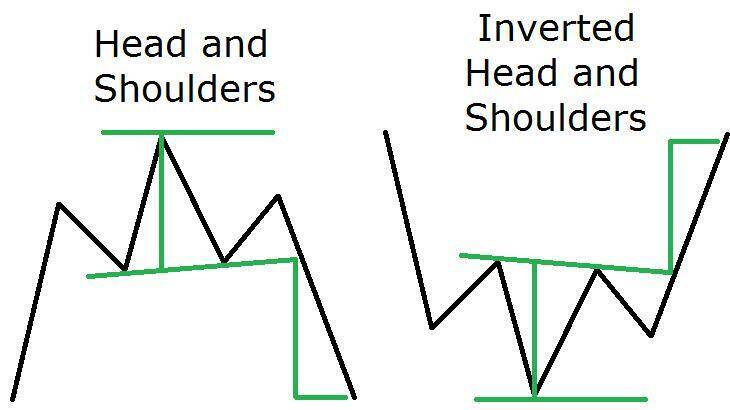

On an adx trend indicator, if ADX is below 25 for more than 30 bars, price enters into a range and has a possibility to consolidate. Then Wilder sought to smooth the data by incorporating the previous period’s ATR value. A volatility formula based only on the high-low range would fail to capture volatility from gap or limit moves. It is an indicator developed by Welles Wilder to measure volatility in commodities. To mark the beginning of downtrend analysts watch for the Negative Directional Indicator to cross above the Positive Directional Indicator. To mark the beginning of uptrend analysts watch for the Positive Directional Indicator to cross above the Negative Directional Indicator.

ADX value

The chart above shows Nordstrom with the 50-day SMA and 14-day Average Directional Index . The stock moved from a strong uptrend to a strong downtrend in April-May, but ADX remained above 20 because the strong uptrend quickly changed into a strong downtrend. There were two non-trending periods as the stock formed a bottom in February and August. A strong trend emerged after the August bottom as ADX moved above 20 and remained above 20. The average true range is a market volatility indicator used in technical analysis. Used to measure the strength of a trend, ADX is one of the most versatile trading indicators out there.

Once you are ready, enter the real market and trade to succeed. In this case, the negative divergence led to a trend reversal. Any time the trend changes character, it is time to assess and/or manage risk. Divergence can lead to trend continuation, consolidation, correction or reversal .

- Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time.

- The belief goes that a market that’s firm and decisive, will have a greater chance of continuing in the current direction.

- So, we want to sell when the RSI indicator breaks and shows a reading below 30.

- This -DI14 is the red Minus Directional Indicator line (-DI) that is plotted along with the ADX line.

- Please let us know if you have any feedback or comments.

It is advisable that the difference between stop loss and resistance must be 2% of the risk-reward ratio. Before selling a stock, we must analyze the trend of the particular stock in a weekly and monthly chart. If ADX is above 23 and the +DMI line moves downwards, which is from above to below the -DMI line then this indicates a sell signal. One of the most accurate indicators used in trading to book more profits is ADX or Average Directional Index.

What is the Average Directional Index (ADX)?

The above calculation will plot the three lines of the ADX indicator. The +DI will be the positive directional indicator, whereas the –DI will be the negative directional indicator. The ADX is a non-directional indicator (essentially the average difference between +DI and –DI) and is plotted from 0 to 100, with no negative values. Analyzing trend strength is the most basic use for the DMI. To analyze trend strength, the focus should be on the ADX line and not the +DI or -DI lines. Wilder believed that a DMI reading above 25 indicated a strong trend, while a reading below 20 indicated a weak or non-existent trend.

Once the data is available one can analyse and predict the trend accordingly. He developed ADX Indicator with commodities and daily prices in mind but it can also be applied to stocks. Click the ‘Open account’button on our website and proceed to the Personal Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity.

Murphy USA: Slowing Growth Affecting Share Price Appreciation … - Seeking Alpha

Murphy USA: Slowing Growth Affecting Share Price Appreciation ….

Posted: Mon, 09 Jan 2023 08:00:00 GMT [source]

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in ouhttps://traderoom.info/itorial policy. This chart shows a cup and handle formation that starts an uptrend when ADX rises above 25. One way to trade using ADX is to wait for breakouts first before deciding to go long or short.

A Positive Directional Index (+DI) is the difference between current highs and previous highs. When the positive DI moves upwards then there will be an uptrend in the market. When the positive DI moves downwards then there will be a downtrend in the market.

The DMI is negative when the prior low minus the current low is greater than the current high minus the prior high. It should have an upward sloping curve to represent the downtrend. The DMI is positive when the current high minus the prior high is greater than the prior low minus the current low.

Notice how the ADX reading went up together with the increase in market trend strength, coming from a low volatility environment. Note – Variations of this calculation typically involve using different types of moving averages, such as an EMA, WMA etc. Positive Directional Indicator (+DI) & Negative Directional Indicator (-DI) act as the pillars of ADX, which is a moving average of the DMI. Hence, a chartist can use the trio of lines together as discussed above to determine both the direction and strength of the trend. This line registers a trend’s strength but it doesn’t show its direction.

- We recommend that you seek advice from an independent financial advisor.

- Normally, the ATR is based on 14 periods and can be calculated on any time frame.

- The stop-loss is a maximum of 2% risk per trade, or whatever the risk you might deem appropriate.

- This will factor into determining which values are appropriate not just for analyzing the strength of a trend, but also for any signals generated.

- When the line is falling, trend strength is decreasing, and the price enters a period of retracement or consolidation.

- Low ADX is usually a sign of accumulation or distribution.

Software packages will usually plot values for +DI and -DI alongside the value of the ADX. Directional movement can either be positive, negative, or zero. It cannot be both positive and negative, and it is either up or down.

Start Slide Show with PicLens Lite